Explainer: Full Truck Alliance (FTA)/Manbang (YMM US)

China "Here Johnny"-ed the stock. Is there an opportunity here?

Hi All!

Welcome to post#2. Today we’ll be looking at a stock that just IPO-ed and subsequently crashed as China tightened regulatory oversight. Is there an opportunity here? Thank you and if you find it interesting and useful, do join the club!

Alright let’s go!

Full Truck Alliance (FTA) (Ticker:YMM) or Manbang as its known in China, IPO-ed on 22nd of June on the NYSE. Company filings I refer to in this post can be found here (at time of writing). The stock did rather well on listing day, seeing a ~13% pop from its IPO price of $19 a share. Then China turned Jack Torrance and took an axe to its own tech cos.

China's Internet watchdog, the Cyberspace Administration of China (CAC), ordered two Chinese-owned, U.S.-listed companies to stop registering new users. The agency placed both firms—Full Truck Alliance, known as China’s “Uber for trucks," and job recruitment site Boss Zhipin, under national security review.

Source: https://fortune.com/2021/07/05/didi-chuxing-stock-app-cybersecurity-full-truck-alliance-boss-zhipin/

So is there an opportunity here? Let’s have a look at FTA in 5 minutes or less:

History 👉 Solving the problem

Business model 👉 Show me the money

The Opportunity 👉 Drivers of Growth

Risk 👉 Besides the obvious

Tea Leaves 👉 Final Verdict

1. History

FTA started life as 2 different companies, Yunmanman (which literally means Full Loading) and Huochebang (Truck Alliance), before their merger in 2017. Hence Manbang, a portmanteau of Yunmanman and Huochebang.

Yunmanman or YMM was founded in 2013 by Zhang Hui and around 5 other co-founders including Miao Tianye. Miao, who had previously worked at Alibaba for 8 years, and the co-founders had no logistics background whatsoever but were drawn to the sector when they realised the industry generated trillions of yuan in revenue simply by face to face trades.

Solving the problem

Back in the old days, heavy truckers would wait in logistics parks for assignments which were scribbled on tiny blackboards. In addition to that, on the return journeys, truckers were driving back with no load, a massive waste of time and fuel which were all what trucking was about really. On the surface, it was obvious how this problem could be solved: Create a system that would play matchmaker between cargo and driver.

Things however, got off to a (literally) rough start. The company sent > 2,000 people to logistics parks around the country to promote the app, only to have their employees beaten up by annoyed drivers who didn’t want to change the way things were done. The marketing staff resorted to dressing and acting like truckers to fit in to stop getting beaten up or kicked out of the industrial estates. YMM soldiered on and just a few years later, they were servicing millions of trucks.

And how could it not? The idea just makes sense! By reducing the information asymmetry between customers and truckers, they can reduce the inefficiently high transportation fees, creating value for BOTH shippers AND truckers.

“Mr. Deng runs a small logistic company in Guangzhou, and his company covers routes connecting Guangzhou to 3 major cities in the southwest of China. Although he owns a small fleet for the last mile delivery, he uses the spot market to meet his need for long-haul FTL (full truck load) transportation.

Before using Yunmanman shipper app, Mr. Deng relied on a long list of truckers he worked with before, blackboards in local logistics parks and truck brokers to find long-haul truckers. Oftentimes, it took dozens of calls or a long wait to find a trucker. In addition, he often encountered price hikes or cargo damages caused by truckers.

Then Mr. Deng started to use Yunmanman shipper app in 2015 and has become a loyal shipper member and frequent user. Nowadays he posts five to eight long-haul shipping orders through Yunmanman shipper app on average every day. Mr. Deng completed 697 shipping transactions on our platform in 2020, representing more than 60% of his total shipping orders during the year. The average time Mr. Deng spent on finding a trucker decreased from over 10 hours to within an hour. The app also enables him to enjoy lower shipping cost by eliminating fees for truck brokers and other middlemen. On average, the cost for each shipment decreased by over 15%, compared to the average cost before using Yunmanman. In addition, cargo damages decreased by 30% due to the availability of reliable truckers on our platform.

Mr. He is a trucker from Ningxia, northwest China. He has been on the road for over 20 years, delivering local agriculture products from northwest China to the Yangtze delta and carrying machinery and equipment on the way back.

His story before using Yunmanman trucker app is all too common: to find a back-haul order from Yangtze delta, Mr. He had to stay at a small hotel near a local logistics park and spend days searching for shipping orders around the park, from truck brokers’ blackboards to small ads taped to telegraph poles. From time to time, he had to bear the cost of an empty return trip. Even when he found a shipping order, he had to worry about making losses. Shippers sometimes canceled shipping orders without paying his travel cost when he was already on his way to pick up cargos or made up excuses for not paying him after delivery.

“Yunmanman app makes finding shipping orders so much easier, and I can find shipping orders with a touch of the screen,” Mr. He says, “I make more trips and more money now and all my trucker friends know how to find shipping orders on Yunmanman app.” “Yumanman also helps me deal with cancelations or late payments,” Mr. He continues. After using Yunmanman app in 2016, Mr. He’s average annual income increased by at least 40% to RMB350,000.

Source: paraphrased from company filings

Marriage of equals

In 2017, after years of explosive growth and inevitably attracting competition, the industry entered a consolidation phase. YMM and Huochebang agreed to merge into Full Truck Alliance, creating the undisputed market leader in the space.

Interesting to note that things were not always so cordial with both companies trading accusations about harassment that have prompted police investigations in the past. But that’s all water under the bridge now.

2. Business model

The company makes money from 3 categories:

Freight Brokerage Services

Freight Listings

Transaction Commissions

Value Added Services

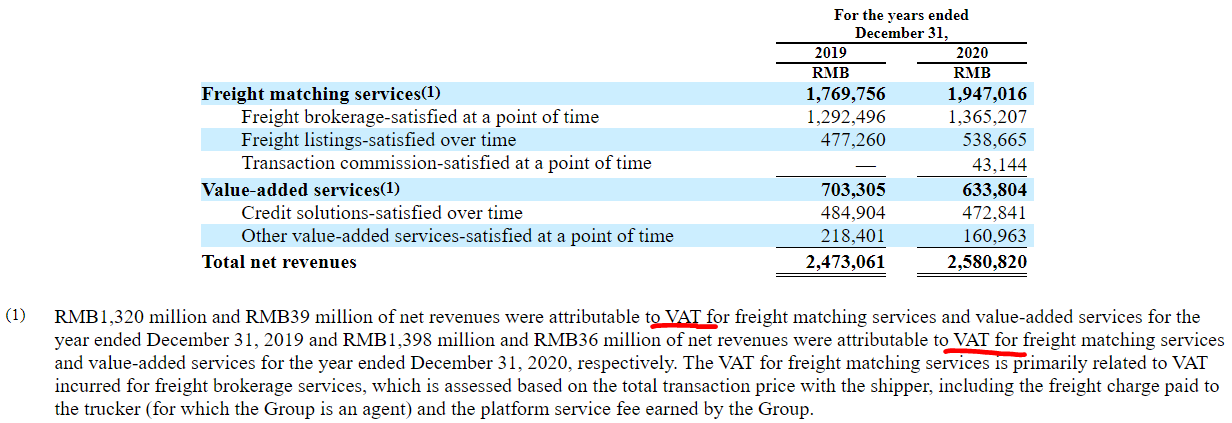

Source: company filings

A) Freight Brokerage Services (~50% of revenue)- Not as straightforward as you think

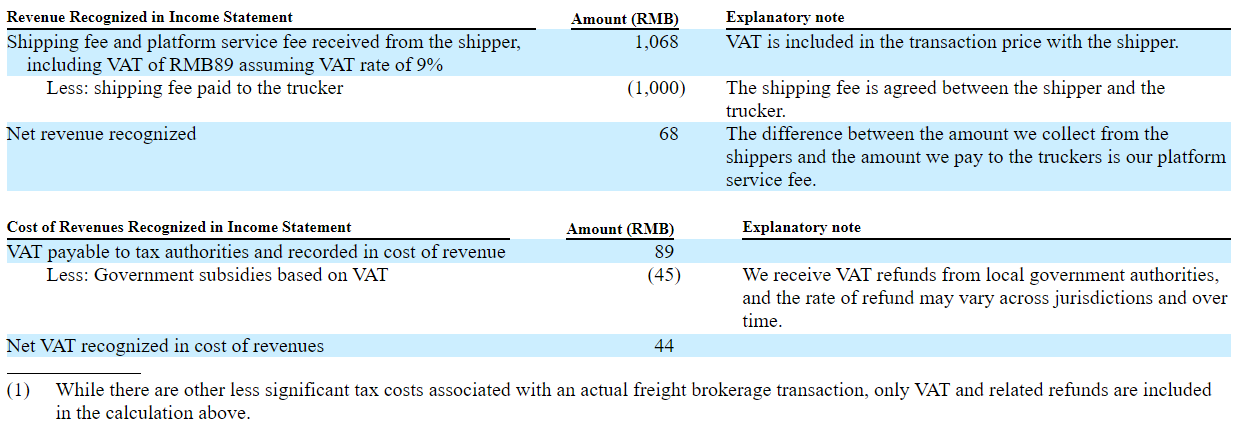

Initially, one might think that its as simple as taking a % of the fee paid to the driver. That is NOT what happens. FTA actually makes the bulk of its revenue from VAT Tax Rebates! (that red underline in the top picture)

As a freight broker, FTA ONLY matches shippers and truckers. It doesn’t handle any transactions between the 2 parties. Payments happen OUTSIDE the platform, offline between the shipper and the trucker.

However, and this is the beauty of it, there is a TAX ISSUE in that the bulk of truckers are individuals who can’t underwrite invoices to shippers for tax purposes.

FTA then steps in as the middleman and enters into contracts with BOTH parties:

Shippers -> to sell shipping service and platform service (which includes VAT) and

Truckers -> to purchase shipping service

The spread between the 2 is the platform service fee.

In this arrangement, it is FTA that “pays” the VAT, which is based on the total shipping service fee. However, FTA gets a TAX REFUND from the local government authorities. FTA then profits from this tax difference!!! THIS is the bulk of how FTA makes its money.

Obviously you can’t be a long term investor in a company who’s entire shtick is making money off a tax loophole. So this CANNOT be the long-term growth driver (geddit) for FTA.

B) Freight Listings (~20% of revenue)- Membership fees

After the merger in 2017, FTA began monetizing the freight listing service by charging a membership fee for frequent shippers, allowing paying shippers to post more shipping orders than non-paying shippers. The rest can still use the platform for free.

Now remember the first way they make money ie the tax rebates? The problem is, as this is a very traditional, face to face industry, most shippers already have their regular drivers and/or the smaller shippers skip the invoice altogether.

The bulk of FTA’s users are actually the brokers, which long established relationships with the shippers. They collect the shipment order info and input it into FTA’s platform. So it is these brokers, with their high volume shipping, which are the natural high frequent users of the platform and hence will be willing to pay the membership fee. Now I believe THIS is the true future of FTA, which as the biggest player will be able to command higher fees in the future.

C) Transaction Commissions (~10% of revenue)- Tinder gold

In 2020, FTA introduced commission fees as a new revenue stream that’s not too dissimilar from..Tinder.

When a trucker finds a shipment info on the platform, he/she (no gender assumptions here) needs to pay a deposit of RMB 100-300 to reveal the shippers contact info. The shippers will get several offers from different truckers and they will pick one based on price or other conditions. For the selected trucker, the FTA platform will return the deposit fee back after deducting a 10-15% service fee (normally around RMB 20 - 30).

Reviews seem to have shown that retention rate is pretty high, which is testament to how loyal customers are to the FTA platform, which ceteris paribus, tells us that FTA has strong pricing power when it comes to these fragmented truckers.

D) Value added services (~20% of revenue)- Tinder gold

The balance is just FTA cross selling other services that a shipper or trucker might need like credit solutions, insurance, traffic tickets, toll collection etc.

3. The Opportunity

A) HUGE, but inefficient market

Carrying over a theme from our last post where we looked at JDL, China’s trucking market is HUGE. It’s the largest in the world, and at an estimated USD 620 billion, its a full 21% larger than the US market. Yet, it is riddled with inefficiencies because its mostly composed of independent truckers leading to a highly fragmented market.

“Despite its sheer scale, China’s logistics industry has low efficiency and high indirect costs. In 2020, China’s total logistics spending accounted for 14.7% of GDP, according to NDRC, compared to approximately 7.6% in the U.S., according to the CIC Report.”

source: company filings

This fragmentation leads to China having a very large intermediary market in the trucking industry, which at USD 186 bn is 3x LARGER than in the US. This is the market which FTA is disrupting and it has a long runway ahead.

B) Potential to Uber-ize Business Model

Google FTA/Manbang and the first thing you will see is that FTA is the Uber or the Didi (Chinese Uber) of trucks. Nothing could be further from the truth.

FTA only acts as a matchmaker, connecting shippers and truckers. Unlike Uber, it DOES NOT set the fee. So there’s no “surge pricing”. As mentioned previously also, all payments are made OFF the platform.

Why can’t FTA be like Uber (or other freight cos like JB Hunt and CH Robinson) and charge the shipper directly?

That’s because FTA is NOT ABLE to, not because it chooses to. The fee for long-haul transportation varies DAY TO DAY and is affected from everything from the weather to whether you need the trucker to load cargo or not. At this stage, FTA isn’t able to get into that granularity. YET.

Its also partly due to behaviour and long established histories of shippers/cargo owners and brokers working together. For FTA to be able to set the fee, it needs to completely disintermediate the ecosystem, removing brokers from the business entirely. And FTA has begun to show progress in this area by collecting pricing information and simulating prices of routes. They have also created a system which is able to differentiate orders by brokers vs cargo owners. It then builds relationships with the cargo owners, thus becoming a broker in its own right. Once enough relationships have been built, FTA can fully Uber-ize its business model, possibly more than 5X-ing their current revenue.

4. Risk (besides the obvious)

A) Competition

With the industry ripe for disruption and trillions of yuan as the ultimate prize for the winning platform, its no surprise that many companies are trying to muscle their way in. Deep-pocketed Didi threw its hat in the ring in 2020, setting up a trucking division to compete in this space.

Didi Freight

So far, Didi Freight focuses on intra-city trucking. However, the market is expecting Didi Freight to introduce inter-city solutions in the second half of 2021. Didi's CEO Cheng Wei has publicly stated their desire to expand its footprint in the road transportation industry. While Didi has a technological advantage in its platform building capability and route planning algorithms, the jury is still out on if they can overcome the problem of the broker.

5. Final Verdict

Final verdict: NOT CONVINCED (yet)

Despite the strong story, 2 things are putting me off:

1) Wait for a clear monetization strategy. As we showed previously, almost half of their revenue comes from tax refunds. That’s not sustainable. They are building out their monetization channels but recent regulatory moves have made me a bit jittery on what can and can’t be done.

2) Competition. The limitless funds of Didi are coming into play soon. Will this lead to another war?

The hunt for the next high conviction idea continues.

-Core Convictions

P.S please do post your thoughts in the comments!